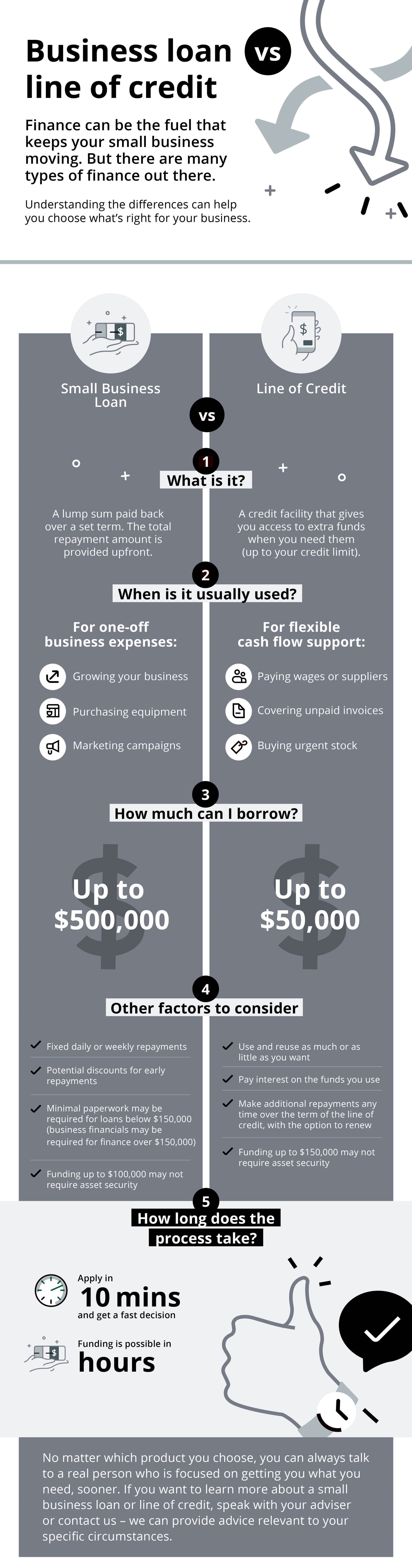

Infographic: Line of credit vs small business loan

Line of credit vs small business loan

You’ve likely heard of a small business loan, but how about a business line of credit? Here’s a quick rundown of the difference between these two business finance options.

Small business owners are used to investing in their business’s growth with their own hard work, but there are times when that’s not enough.

Having access to external funding can often make or break businesses that need to cover cash flow gaps that are out of their control. Funding can also be an essential ingredient for business owners looking to take on a new growth opportunity. The array of finance options can be dizzying, but the good news is that technology has made it more accessible than ever before. Banks aren’t the only option available, with lenders like Prospa specialising in the specific needs of small businesses and providing funding more quickly and with as much flexibility as possible.

For most small businesses, two common finance products that can serve their needs are a small business loan and a business line of credit.

So how do you decide which facility to use?

If your business needs funds for opportunity, growth or cash flow support, a business loan or a business line of credit could be the answer. Speak with us about the right solution for your business.

The information on this website is provided for general information only and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from financial, legal and taxation advisers. Although every effort has been made to verify the accuracy of the information, we disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy, or omission from the information or any loss or damage suffered by any person directly or indirectly through relying on this information.

There's more than one way to nurture your business

We love helping businesses grow with the latest info and ideas to educate and inspire. We can also guide you to a funding solution to help bring those business dreams to life.